how to calculate a stock's price

The book value is worked out from the balance sheet as total assets minus. All Straight from Industry Pros.

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Divide the current share price by the stocks book value.

. In this case the adjusted closing price calculation will be 20 1 21. Click the Calculate Stock Price button. Heres an easy formula for calculating the value of preferred stock.

P D 1 r g where. Price of Stock A is currently 10000 per share or P0. Calculate the PE ratio.

If you calculate fair value to be 100 and you used a 12 percent discount. We can rearrange the equation to give us a companys stock price giving us this formula to work with. 217000000 Annual Dividends per share.

If the stock price goes up to. Ad This writers last stock recommendation soared hundreds of percent in a matter of weeks. P Current Stock Price g Constant growth rate in perpetuity expected for the dividends r Constant cost of equity capital for that company or rate of.

Announces a 21 stock. The process of determining the maximum price you should pay for various stocks. Pursue Your Goals Today.

Stock value Dividend per share Required Rate of Return Dividend Growth Rate Rate of Return Dividend Payment Stock Price Dividend Growth Rate. Fields Terms and Definitions. Par value of one share of preferred.

How to Calculate share value Example. Enter the number of shares purchased Enter the purchase price per share the selling price per share Enter the commission fees for buying and selling. The formula to calculate the target price is.

Just follow the 5 easy steps below. Learn More About Account Fees Minimums Promotions. Calculating Todays Stock Prices.

New report out now. 67 Last 12-months earnings per share. Ad The Investing Experience Youve Been Waiting for.

Last 12-months earnings per share. Then divide by the number of shares issued. For instance if you want to Step 3.

Current Stock Price. Enter the required rate of return. If you buy the stock at 3 the PE ratio is 3 which is calculated by dividing the price of the stock by its earnings per share or 3 divided by 1.

Fair value is the price you can pay and expect to generate your required rate of return in that stock. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. 268 Historical PE ratio.

These Top Brokerages Offer Tools For New Investors And Those With Years Of Experience. Dividends are expected to be 300 per share Div. Here look for the trailing PE as of December 31st 2019.

Find out which stock he believes will be next. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. For an investor price target reflects the price at which he will be willing to buy or sell the stock at a particular period of time or mark an exit from their current position.

Annual Dividends per share. Cost of Preferred Stock Preferred Stock Dividend D Preferred Stock Price P. Compare the PE ratio for your company with other companies in the same industry.

Stock price price-to-earnings ratio earnings per share. Price Estimated EPS Trailing PE where Price is the variable. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

This will give you a price of 667 rounded to the nearest penny. The price of Stock A is expected to. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Ad Compare Brokers Today.

How To Calculate Future Expected Stock Price The Motley Fool

Present Value Of A Growing Annuity Calculator Double Entry Bookkeeping Annuity Calculator Calculator Annuity

Is There A Mathematical Formula To Calculate A Stock Price Quora

How To Calculate Stock Prices With The Dividend Growth Model In Microsoft Excel Microsoft Office Wonderhowto

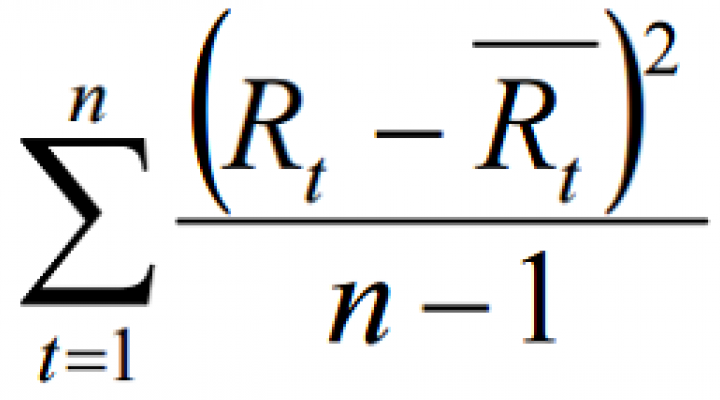

How To Calculate The Historical Variance Of Stock Returns Nasdaq

Price Volatility Definition Calculation Video Lesson Transcript Study Com

How To Calculate The Historical Variance Of Stock Returns Nasdaq

What S A Typical Day For Someone In M A Cost Of Capital Investing Investment Companies

Present Value Of Stock With Constant Growth Formula With Calculator

How To Calculate The Issue Price Per Share Of Stock The Motley Fool

Assessing A Stock S Future With The Price To Earnings Ratio And Peg Stock Futures Peg Being Used

Common Stock Formula Calculator Examples With Excel Template

This Free Online Stock Investment Calculator Will Calculate The Expected Rate Of Return Given A Stock S Current Dividend Investing Online Mortgage Online Stock

How To Calculate Future Expected Stock Price The Motley Fool

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)